Canada Tax Returns for NRIs

Cross-Border Tax Compliance Made Simple with Dinesh Aarjav & Associates

Navigating Canada’s tax system as a Non-Resident Indian (NRI) or globally mobile professional can be complex, especially if you have ties to India or other countries. Canada taxes based on residency, not just citizenship—meaning even temporary residents, work permit holders, and returning Indians may have Canadian tax obligations.

At Dinesh Aarjav & Associates, we specialize in Canada-India cross-border tax filing, helping NRIs and expatriates stay compliant with the Canada Revenue Agency (CRA), avoid double taxation, and report global assets properly under Canadian and Indian tax laws.

Whether you’re a student, worker, entrepreneur, or investor with Canadian-source income, we provide expert tax filing solutions tailored to your global mobility profile.

Cross-Border Tax Compliance Made Simple with Dinesh Aarjav & Associates

Navigating Canada’s tax system as a Non-Resident Indian (NRI) or globally mobile professional can be complex, especially if you have ties to India or other countries. Canada taxes based on residency, not just citizenship—meaning even temporary residents, work permit holders, and returning Indians may have Canadian tax obligations.

At Dinesh Aarjav & Associates, we specialize in Canada-India cross-border tax filing, helping NRIs and expatriates stay compliant with the Canada Revenue Agency (CRA), avoid double taxation, and report global assets properly under Canadian and Indian tax laws.

Whether you’re a student, worker, entrepreneur, or investor with Canadian-source income, we provide expert tax filing solutions tailored to your global mobility profile.

Who Must File Tax Returns in Canada?

You are required to file a Canadian income tax return if:

You are a resident or deemed resident of Canada for tax purposes

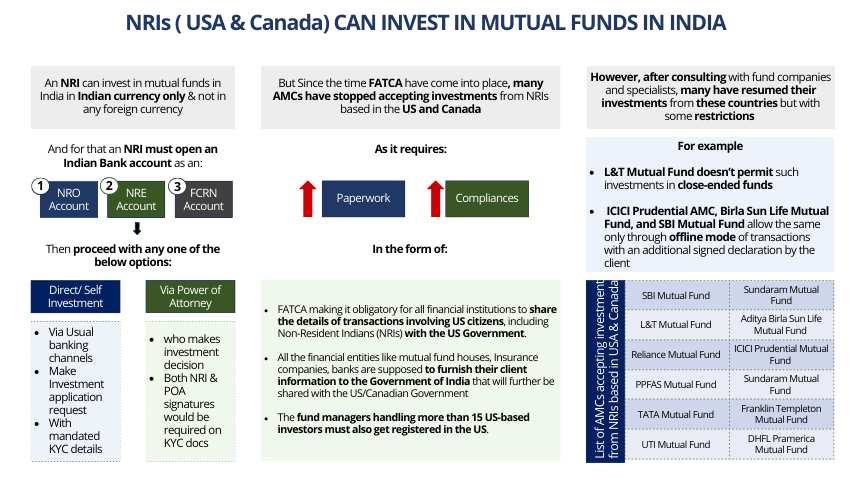

You earn income from Canadian sources (employment, rental, capital gains, etc.)

You want to claim a refund or tax credit

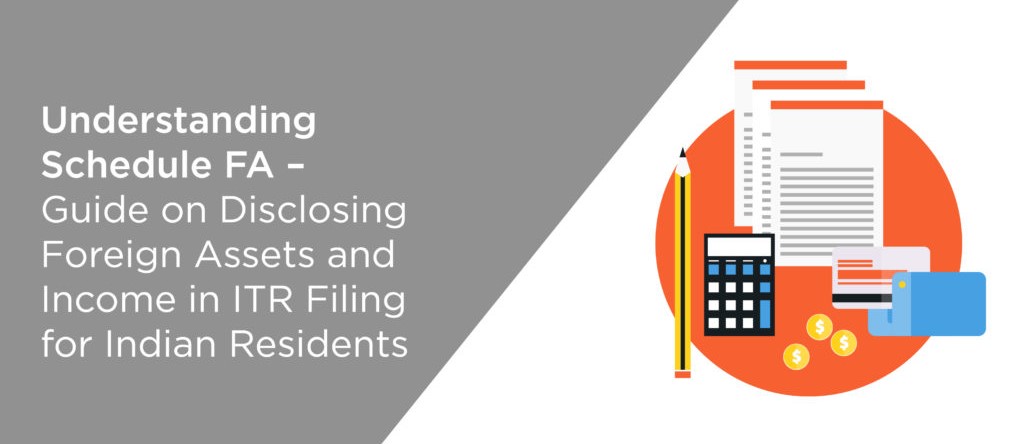

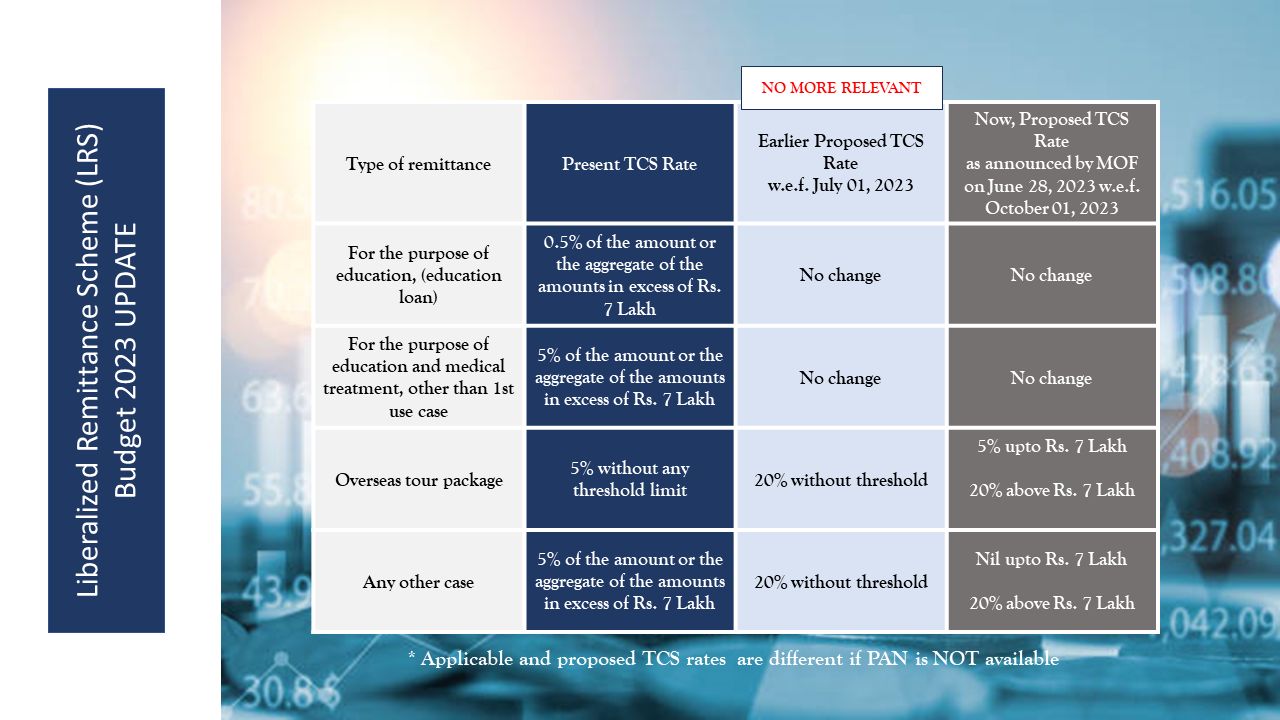

You have foreign income or property over the reporting thresholds

You are emigrating or immigrating during the year

Read More

.webp)

(1).jpg)

.webp)

-min.png)