WhatsApp

WhatsApp

Call Us

Call Us

Email Us

Email Us

Whatsapp Community

Whatsapp Community

Many of our NRI clients are finding themselves on the receiving end of nudging letters from HMRC UK or notices under sections 148 and 148A of the Income Tax Act, 1961 in India. These notices indicate that the government suspects the assessee of evading income taxes and having undisclosed income related to offshore jurisdictions.

To provide some context, over 100 countries have joined forces to commit to the multilateral exchange of information through the Common Reporting Standard (CRS), initiated in response to a G20 request and approved by the OECD Council on July 15, 2014. The CRS urges jurisdictions to gather financial information from their financial institutions and automatically share it with other jurisdictions on an annual basis. It outlines the financial account information to be exchanged, the reporting obligations of financial institutions, the types of accounts and taxpayers covered, as well as standard due diligence procedures to be followed by these institutions.

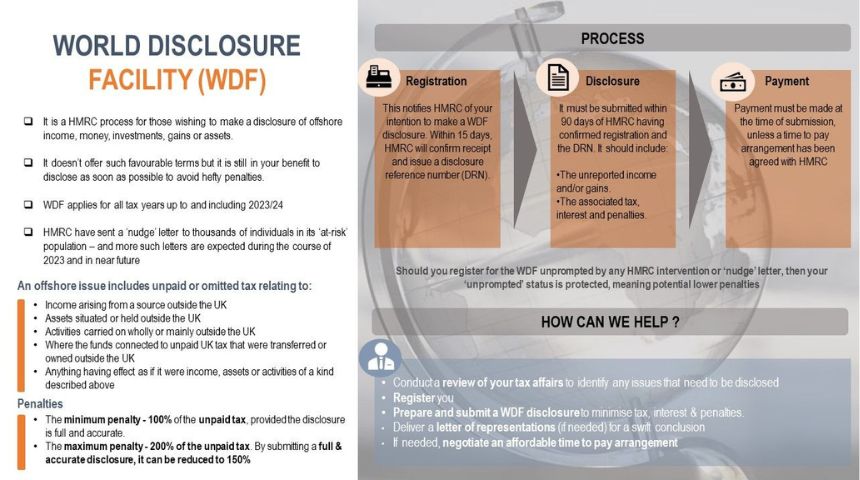

Consequently, the Worldwide Disclosure Facility (WDF) is now being employed to disclose UK tax liabilities linked, either wholly or partially, to offshore matters.

While the WDF may not offer exceptionally favorable terms, it is still in your best interest to disclose your liabilities promptly to avoid substantial penalties. It is available to anyone who needs to disclose a UK tax liability related to offshore income or gains, spanning all tax years up to and including 2023/24.

UK residents with offshore income are consistently receiving 'Nudge letters,' reminding them of potential income evasion and unreported offshore income. These letters aim to recover additional tax liabilities that arise due to varying tax rates across countries. Residents are obligated to pay these additional tax liabilities based on HMRC computations for past years. But what about the years ahead?

Tax planning in your country of residence (in this case, the UK) is no longer sufficient. With extensive information exchange occurring between countries, taxpayers must now proactively plan their global income. This involves considering the local tax laws of every country where income is sourced

Stay in the loop, subscribe to our newsletter and unlock a world of exclusive updates, insights, and offers delivered straight to your inbox.