WhatsApp

WhatsApp

Call Us

Call Us

Email Us

Email Us

Whatsapp Community

Whatsapp Community

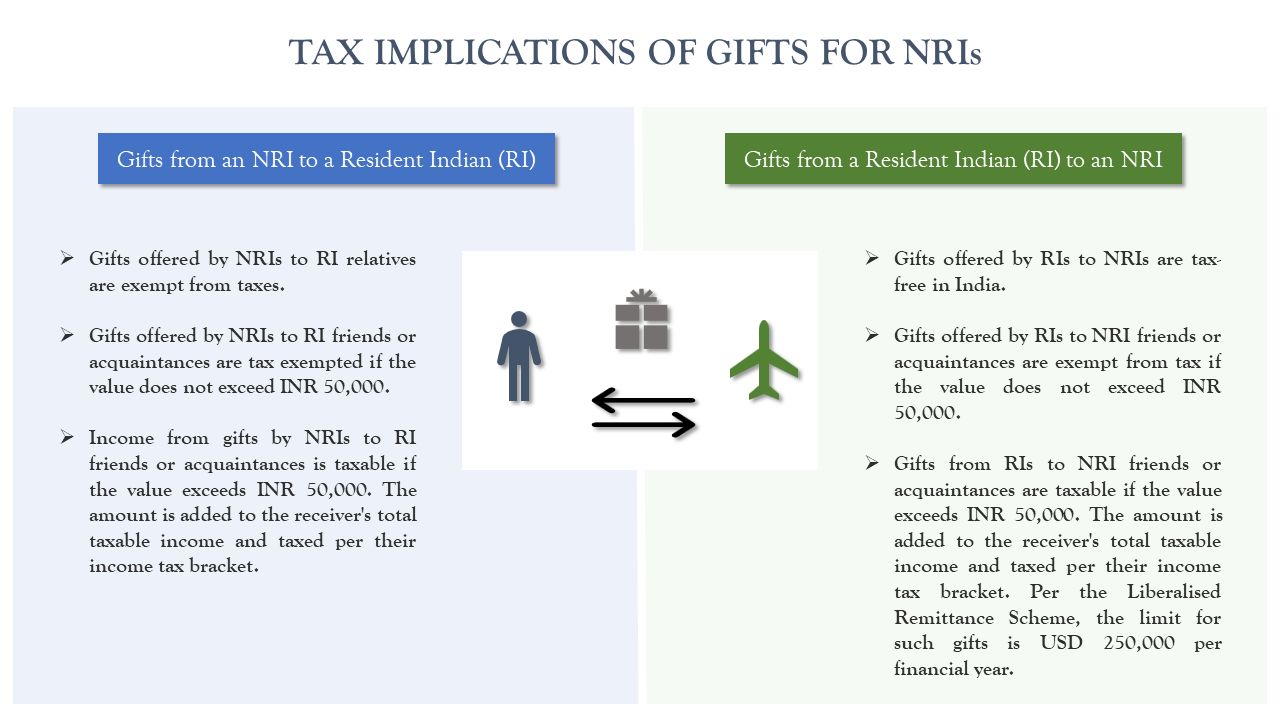

When it comes to gifting money to NRIs, there are specific rules and considerations to keep in mind to ensure compliance with Indian tax regulations. Here's a breakdown of the key rules:

1. Source of Gift Money: Resident Indians (RIs) are permitted to send monetary gifts to NRIs, and these funds can be deposited into the NRO (Non-Resident Ordinary) accounts of the recipients.

2. Immovable Property Gifts: RIs have the option to gift immovable property to NRIs, with the condition that the remittance of sales proceeds does not exceed USD 1 million annually. For more details on the sale of immovable property by NRIs in India, you can refer to our previous post.

3. Gifts in the Form of Shares and Securities: NRIs can receive gifts in the form of shares and securities from their relatives. However, it's essential to note that the total value of these gifts should not exceed 5% of the company's paid-up capital.

4. Cash Gift Penalties: There are penalties associated with cash gifts exceeding INR 2 Lakh. To avoid penalties, it is advisable to receive monetary gifts through secure channels such as bank transfers, remittances, or cheques.

5. Exemptions from Gift Tax: Gift tax in India does not apply to certain types of gifts. Wedding gifts and inheritances are exempt from gift tax, regardless of whether the recipient is a relative or not.

6. Taxation of Immovable Properties Abroad: Immovable properties located outside India, which RIs receive as gifts, are typically tax-free in India. However, it's important to be aware that they may be subject to the tax laws of the foreign country where the property is situated.

These guidelines help clarify the tax implications and regulations surrounding gift money for NRIs in India.

Stay in the loop, subscribe to our newsletter and unlock a world of exclusive updates, insights, and offers delivered straight to your inbox.