WhatsApp

WhatsApp

Call Us

Call Us

Email Us

Email Us

Whatsapp Community

Whatsapp Community

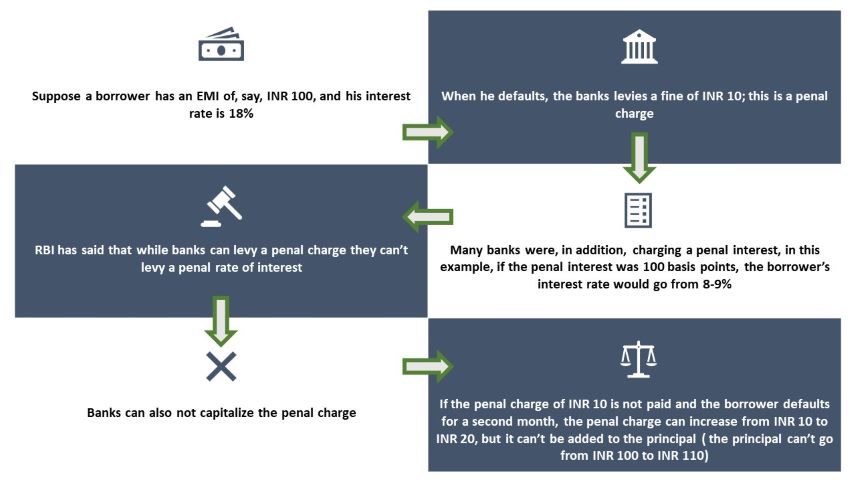

Starting from January 1, 2024, lenders will impose penalties on defaulting borrowers in the form of 'penal charges' rather than 'penal interest' added to the interest rate applied to advances.

Penalties, when enforced due to a borrower's non-compliance with the essential terms and conditions of the loan contract, will now be termed as 'penal charges.' These charges will no longer be calculated as 'penal interest' added to the interest rate on the loans. Furthermore, there will be no capitalization of penal charges, meaning that no additional interest will be computed on these charges. However, standard procedures for interest compounding in the loan account will remain unaffected.

The Reserve Bank of India (RBI) has instructed lenders to develop a Board-approved policy regarding penal charges or similar charges on loans, irrespective of their nomenclature.

The amount of penal charges must be reasonable and proportionate to the extent of non-compliance with the essential terms and conditions of the loan contract, ensuring fairness and consistency within specific loan or product categories.

For loans granted to 'individual borrowers for non-business purposes,' penal charges shall not exceed those imposed on non-individual borrowers for equivalent breaches of essential terms and conditions.

Lenders are mandated to clearly disclose both the amount and rationale behind penal charges in the loan agreement, as well as in the most pertinent terms and conditions or Key Fact Statement, where applicable. This information must also be prominently displayed on the lender's website under the 'Interest Rates and Service Charges' section.

Additionally, whenever reminders are issued to borrowers concerning their failure to adhere to the crucial terms and conditions of the loan, the corresponding penal charges will be explicitly communicated to them

Stay in the loop, subscribe to our newsletter and unlock a world of exclusive updates, insights, and offers delivered straight to your inbox.