WhatsApp

WhatsApp

Call Us

Call Us

Email Us

Email Us

Whatsapp Community

Whatsapp Community

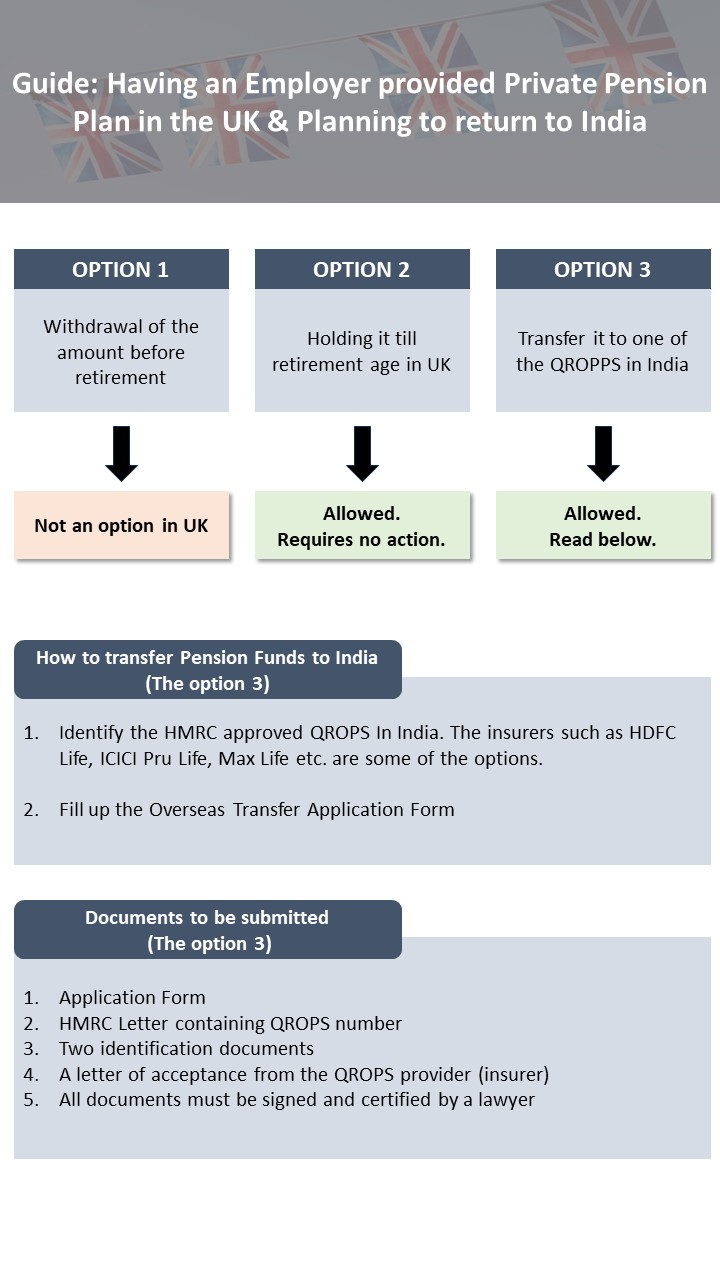

Many Indians working abroad contribute to private pension plans, such as those provided by employers in the UK. When the time comes to return to India, understanding what to do with your UK pension can be challenging. Should you hold on to it in the UK until retirement, transfer it to India, or withdraw it prematurely? The rules can vary significantly between countries. Here, we take a closer look at your options for managing a UK pension when moving back to India.

In the UK, accessing pension funds before reaching retirement age is generally not allowed. However, you have two primary options:

Transferring your UK pension to India involves moving your funds to a QROPS approved by His Majesty's Revenue & Customs (HMRC), the UK's national taxing authority. Here’s how you can go about it:

If you choose to keep your pension in the UK until retirement, the pension funds will be credited to your specified bank account in India after you retire. However, many people prefer not to wait and opt for the transfer to QROPS.

By understanding these options and following the necessary steps, you can ensure a smoother transition of your pension funds when returning to India.

Stay tuned for our next post, where we will explore the US pension scenario for returning Indians

Stay in the loop, subscribe to our newsletter and unlock a world of exclusive updates, insights, and offers delivered straight to your inbox.