WhatsApp

WhatsApp

Call Us

Call Us

Email Us

Email Us

Whatsapp Community

Whatsapp Community

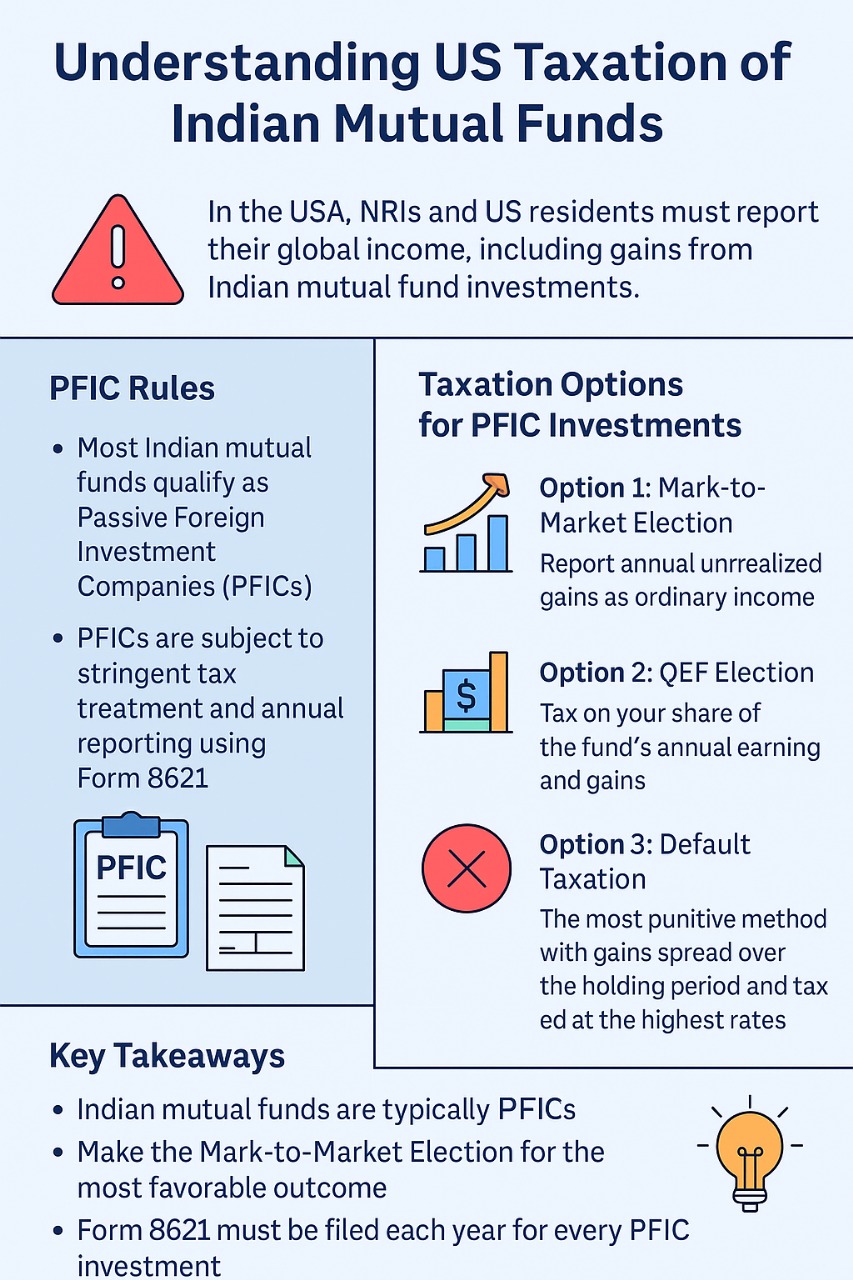

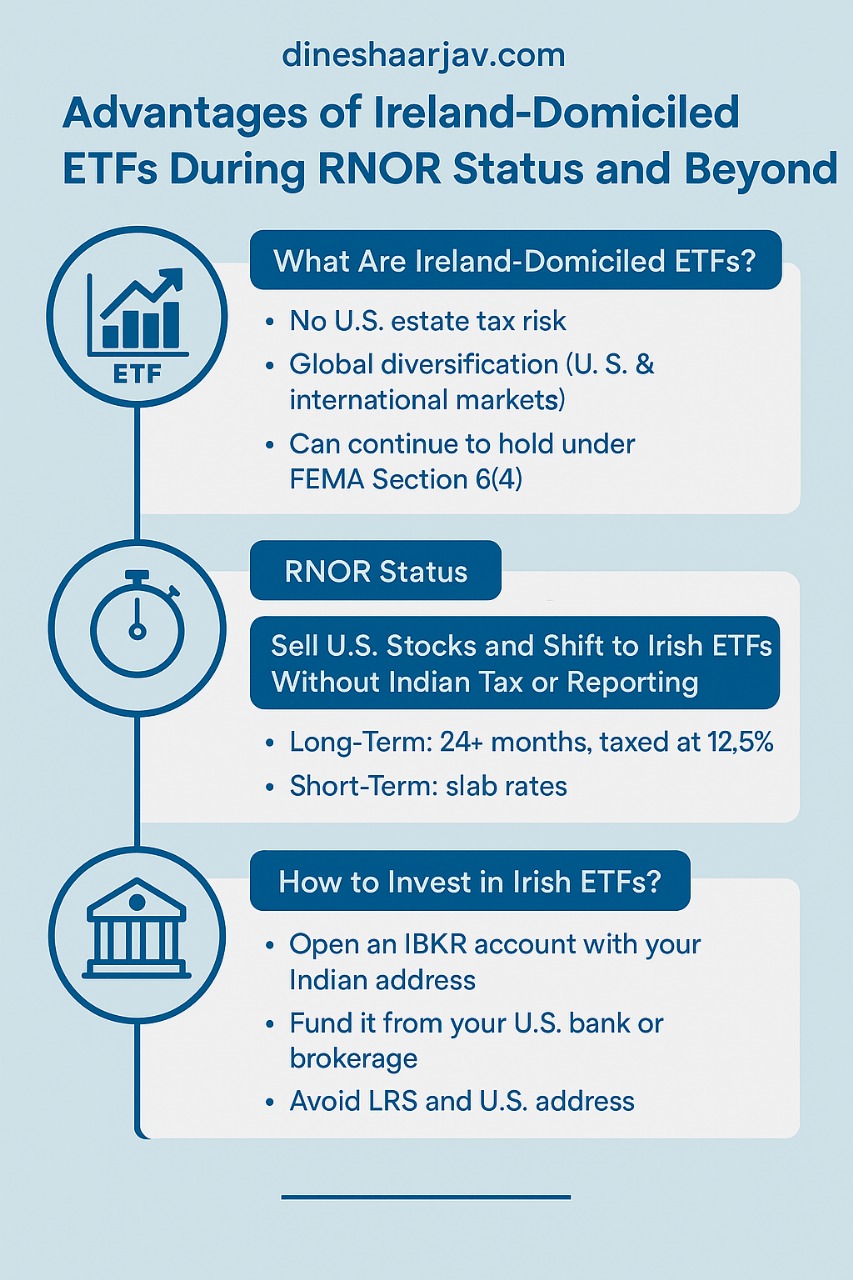

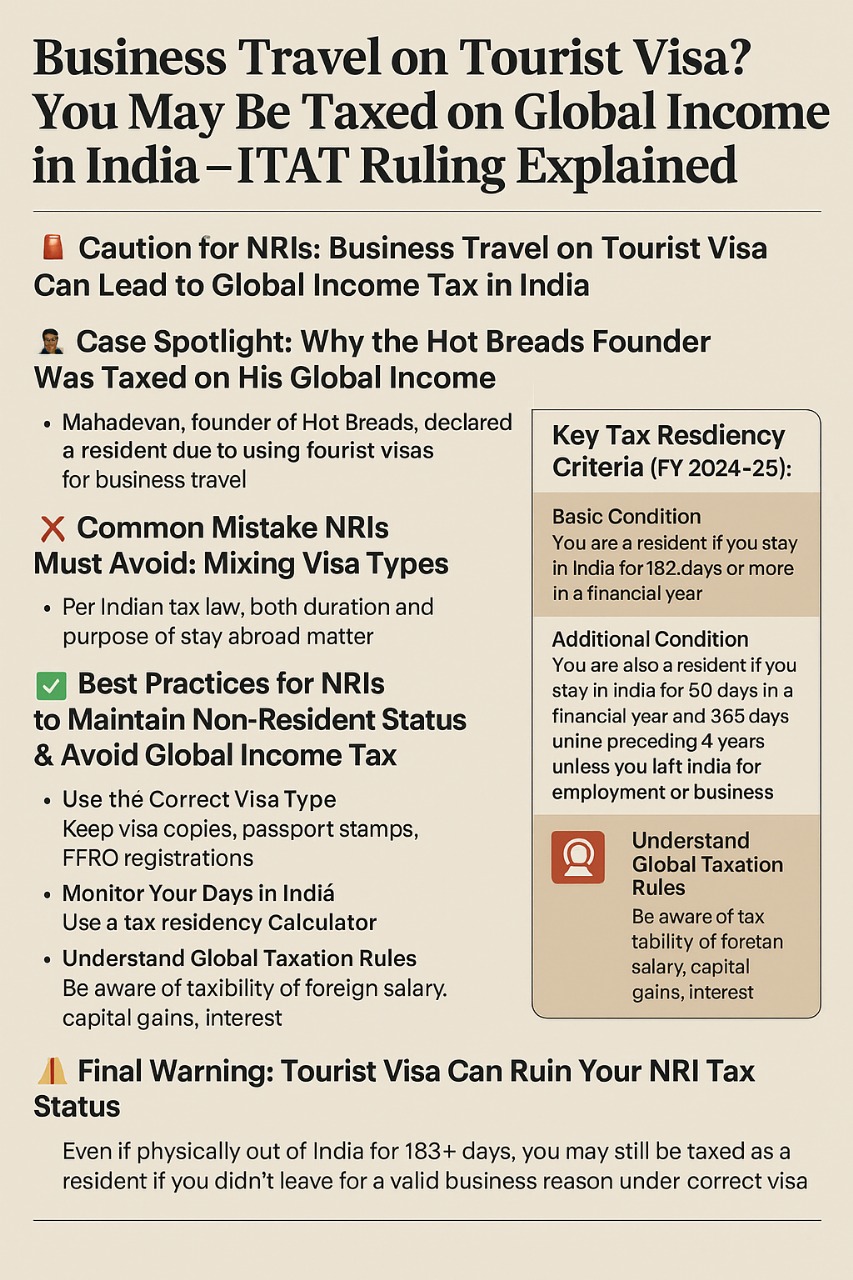

Mutual funds are favoured by NRIs for low-risk, high-return investments. These diverse portfolios include bonds, stocks, and assets. Unlike individual shares, investments are spread across multiple securities. With proper guidance, mutual funds offer tax efficiency. For NRIs, understanding NRI taxation on mutual funds is vital for informed investment decisions.

Yes, NRIs globally can invest in Indian mutual funds by opening NRE, NRO, or FCNR accounts. Due to FEMA regulations, regular savings accounts are not eligible for investments, and all transactions must be made in Indian Rupees.

NRIs in the US and Canada may encounter challenges due to stringent paperwork under FATCA. However, we provide a curated list of Mutual Fund Houses accepting investments from NRIs in these regions.

Understanding the types of returns and nri taxation on mutual funds is crucial for NRI investors. There are two main types of returns – dividend and capital gains – each subjected to specific taxation rules.

Dividends represent the share of profits distributed among investors and are taxed based on individual income tax slab rates. Before Union Budget 2020, dividends were tax-free, but now they are subject to individual taxation.

Capital Gains occur upon selling mutual funds, and the taxation varies based on the type of investment and holding period.

Short-term Capital Gains (STCG), for investments held for less than one year, are taxed at 15%.

Long-term Capital Gains (LTCG), for investments held for more than a year, are taxed at 10% if gains exceed Rs 1 lakh. Prior to April 1, 2018, LTCG was tax-free.

Short-term gains (less than three years) are taxed based on the individual's slab rate.

Long-term gains (more than three years) are taxed at 20% with the benefit of indexation. Post-Finance Bill 2023 amendment, indexation benefit has been eliminated, and capital gains are taxed based on the slab rate.

As mentioned above, NRIs can invest in mutual funds, whether online or offline, by using an NRO, NRE or FCNR account.

An NRI has 2 methods of investing:

As the name suggests, with this method, the NRIs can start investing directly in mutual funds without consulting any third-party agent or investor.

In this method, a professional investor invests the NRIs’ money in mutual funds.

To invest in any bond, security, or to open an account in a bank, it is mandatory to go through the Know-Your-Customer (KYC) norms and other formalities. Similarly, while investing in mutual funds, residents of India and NRI, both have to go through the same. The following are some regulations and steps that an NRI has to abide by before investing in mutual funds:

To complete the verification, an NRI has to submit a copy of their passport along with the pages that have the person’s name, address, age, photo, and other relevant information printed on them. Along with the passport, residential proof is also required.

When payment is done to the fund house via a cheque or a draft, Foreign Inward Remittance Certificate (FIRC) needs to be attached. In the absence of the FIRC, a letter from the bank can also be considered. The purpose of FIRC is to confirm the source of the funds.

After redemption of the corpus, investments and gains, the Asset Management Company (AMC) will credit the amount to the account after deductions of any applicable taxes. They can also write a cheque to the person. Directly crediting the corpus in the NRO/NRE account is also available through some AMCs. If the NRI opts for a non-repatriable investment, the corpus or the redeemed amount can only be credited to the NRO account.

As per income tax act, the following exemptions are available for NRI taxation on mutual funds to take benefit and reduce their tax liability with respect to tax on mutual funds:

1. Section 80C Deductions: NRIs can claim deductions under Section 80C for investments in specified mutual fund schemes like Equity-Linked Savings Schemes (ELSS). The maximum deduction allowed under this section is INR 1.5 lakhs.

2. Benefit of Double Taxation Avoidance Agreements (DTAA): NRIs may fear that they have to pay tax twice on the same income. NRIs earn income in their country. They may also earn an income in India. Income earned in India is taxed in India. That income may also attract tax in their resident country. This would mean that an NRI has to pay tax twice on the same income. Under the Double Tax Avoidance Agreement (DTAA), NRIs can avoid paying taxes twice. India has signed DTAA agreements with many countries to prevent double taxation of income. NRIs can take advantage of these agreements to reduce the tax liability on their mutual fund investments.

Stay in the loop, subscribe to our newsletter and unlock a world of exclusive updates, insights, and offers delivered straight to your inbox.