WhatsApp

WhatsApp

Call Us

Call Us

Email Us

Email Us

Whatsapp Community

Whatsapp Community

Q. So, the First Question Is as Basic As, Can an NRI Even Sell a Property to Another NRI?

A. The answer is - Yes.

The different scenarios for such a transfer can be:

An NRI can sell any immovable property to another NRI other than agricultural land, farm house or plantation property within India.

Gifting a property

An NRI can gift any immovable property to another NRI other than agricultural land, farm house or plantation property within India.

Receiving a property in Inheritance

An NRI can inherit any immovable property from an NRI. There are no restrictions on even receiving an agricultural land/ farm house/ plantation property situated in India.

Q. Are There Any Guidelines Around the Consideration for Such Transfer?

A. Yes, there are guidelines under the Income Tax Act to regulate the consideration for such transfers. One can’t just transfer the property at any random consideration. Any amount negotiated between the buyer and the seller will be the full value of consideration, but if such value is lower than the Guidance value/ Circle rate/ Government value and the variation is more 10%, then such Guidance value/ Circle rate/ Government value would be taken as the full value of consideration for the purpose of both the buyer and seller. The above guidelines are relevant for both Taxation and Stam Duty calculation purposes.

Q. Can 2 NRIs Exchange a Property Situated in India (Permitted by Law) for Cash, If Such an Exchange Is Happening Outside India?

A. No, such transaction is not permitted and it is regulated by FEMA and Income Tax Act.

As per Income Tax Act, no person is permitted to accept INR 20,000 or more in cash in case of transfer of any immovable property. Hence, if the amount under consideration is INR 20,000 or more, the transaction has to be settled and executed through the banking channels in India.

Q. Which Is the Bank Account to Be Used by Buyer and Seller for the Transaction?

A. So, now let us now understand the banking channel to be used by the seller and the buyer:

Seller:

The seller is bound to receive the consideration in HIS OWN NRO A/c.

Buyer:

The buyer can make the payment from his NRO or NRE or FCNR A/c. Further, there are two basis of making payments – Repatriable basis or Non Repatriable basis. If the payment is made from NRE or FCRN A/c, it is said to be done on Repatriable basis and if the payment is done from NRO A/c, it is said to have been made through Non – Repatriable basis.

The relevance of the above comes into play when the buyer wants to resell the property. If the payment was made on Repatriable basis, it is relatively easier to resell the property as there would be lesser restrictions for remitting the funds outside India. For eg. – if the value of consideration for such transaction is more than 1 Mn $, then if the original payment was done on Non Repatriable Basis, RBI approval would be required for remitting this money outside India. On the other hand, if the original payment was done on Repatriable basis, the money on reselling can be remitted to abroad without any restrictions.

Q. What Are the Requirements Under FEMA and Income Tax Act for Executing Such a Transaction?

A. Under FEMA:

It is mandatory for both, buyer and seller to exchange their KYC documents with each other.

Obtain proof of Address, Residential status, Tax code

Under Income Tax Act,

Buyer:

Obtain TAN

Deduct & Deposit TDS at appropriate rate

File TDS Return

Obtain RBI approval, if required

Seller:

Open NRO A/c

Obtain the lower/ NIL rate TDS certificate

Obtain Form 15CA & CB for remittance of funds

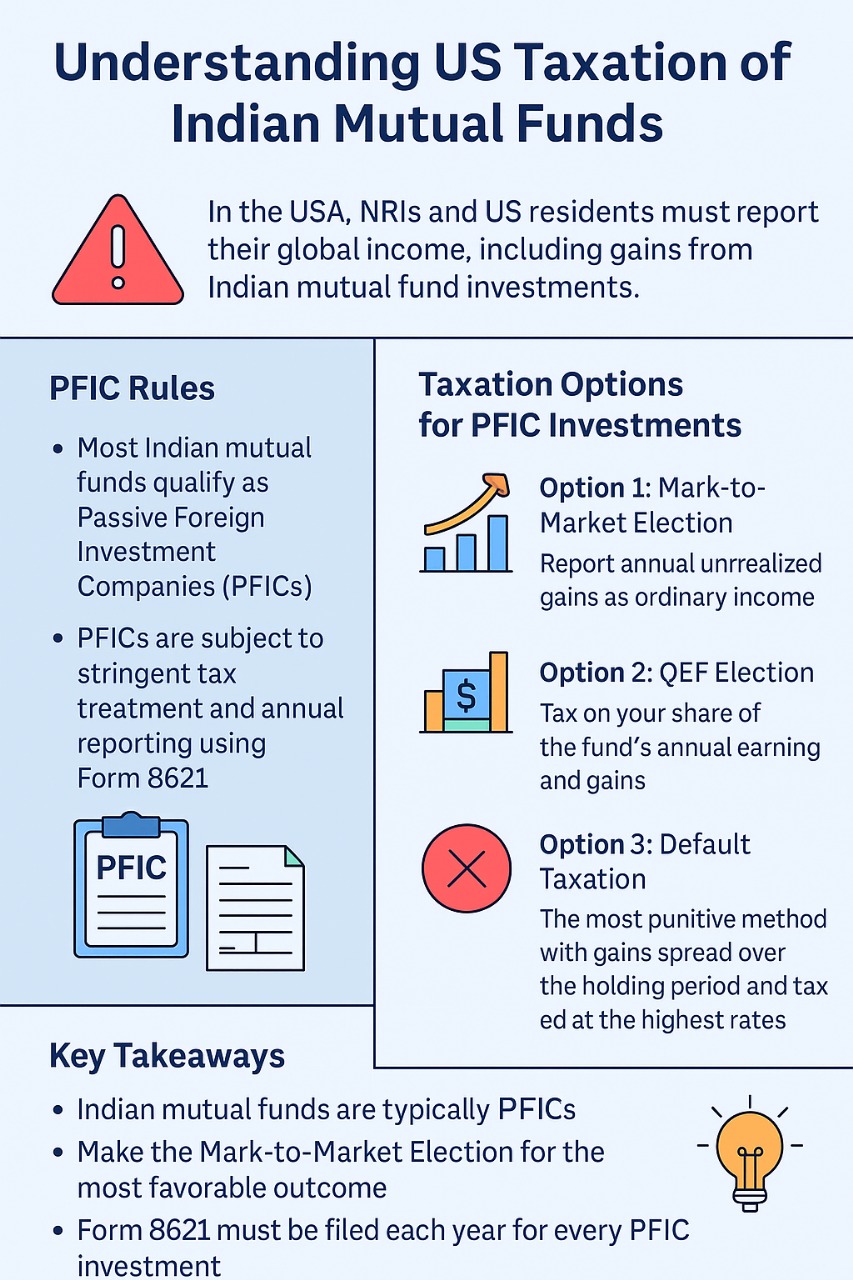

Q. Can the Country of Residence Tax Such a Transaction?

A. Yes, the country of residence may also tax the transaction of selling an immovable property situated in India as per their local laws. For a matter of fact, every country has its own inheritance laws, laws for taxation of property and laws for taxation of Global income. In general, what has been observed in most cases, the country of residence also taxes such transactions. But to a tax payer’s relief India has entered into DTAAs with ~90 countries! This means that even if the tax needs to be paid in the country of residence, the tax payer can claim the credit to the extent of tax paid in India and avoid the double taxation.

Stay in the loop, subscribe to our newsletter and unlock a world of exclusive updates, insights, and offers delivered straight to your inbox.