WhatsApp

WhatsApp

Call Us

Call Us

Email Us

Email Us

Whatsapp Community

Whatsapp Community

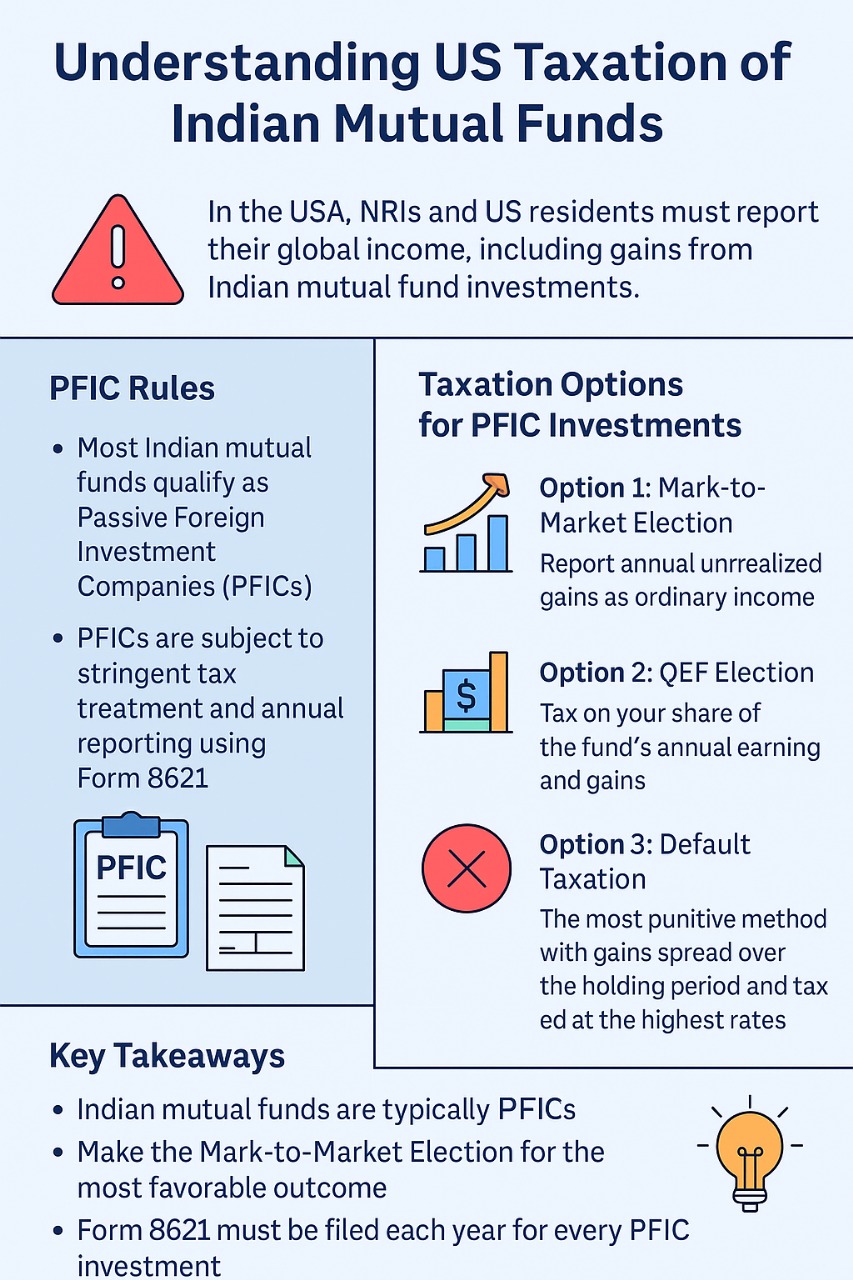

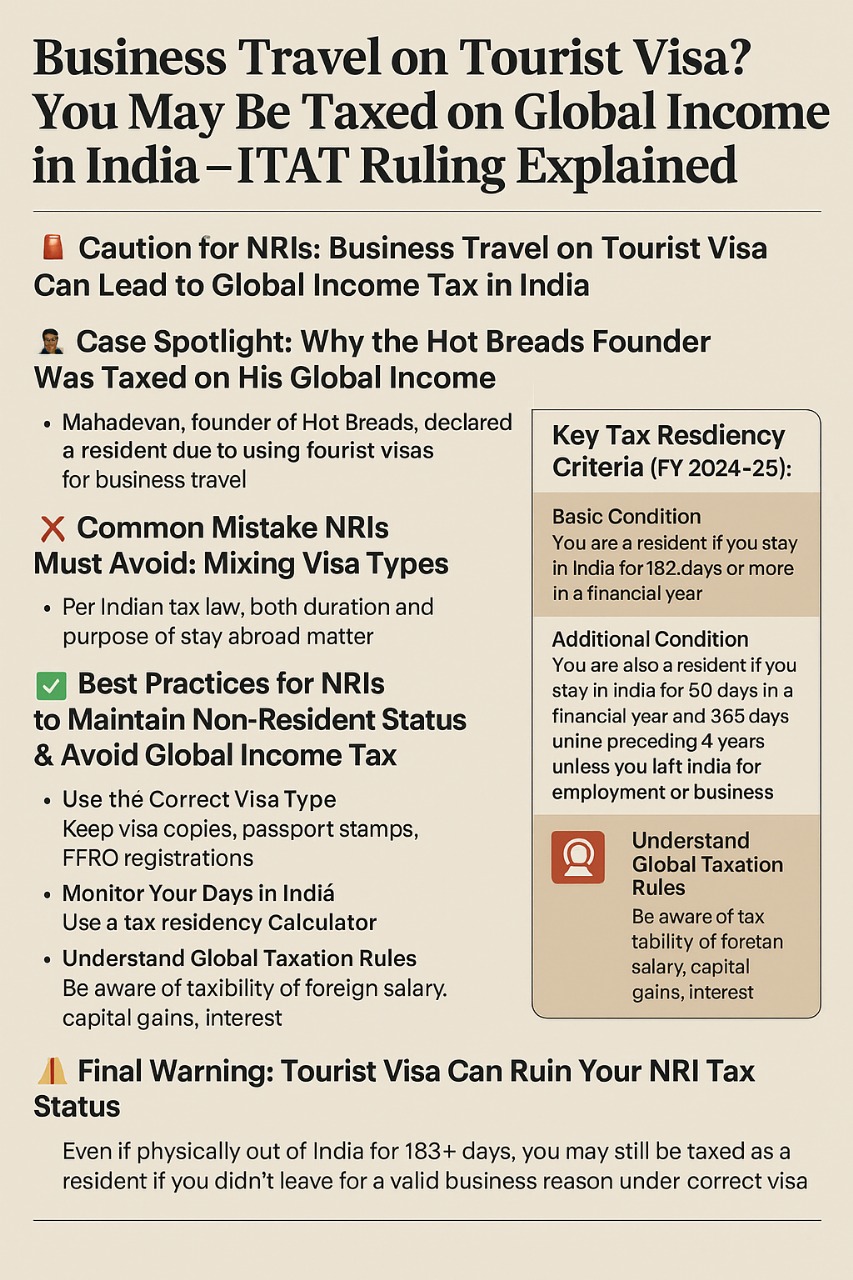

The taxability of an individual in India depends upon one’s residential status in India for any particular financial year. The term residential status has been defined under the income tax laws of India and must not be confused with an individual’s citizenship in India. An individual may be a citizen of India but may end up being a non-resident for a particular year. Similarly, a foreign citizen may end up being a resident of India for income tax purposes for a particular year. Therefore, determining residential status is crucial for understanding tax obligations.

An NRI, or Non-Resident Indian, refers to an Indian citizen or Person of Indian Origin (PIO) who resides outside India for employment or business purposes. The definition of NRI can vary depending on the context and governing laws in India.

The two main laws that govern and prescribe the rules for NRIs in India are as follows:

Income Tax Act - Governs the tax liabilities of NRIs

Foreign Exchange and Management Act (FEMA) - Governs all transactions and investments, the opening of bank accounts, etc., of NRIs

The Income Tax Act and the Foreign Exchange Management Act (FEMA) have different definitions of an NRI.

The Income Tax Act has definitions based on the number of days spent in India and the Income in India (this has been discussed in detail below).

On the other hand, as per FEMA Act, the intention of the person living in India / leaving India is equally important in addition to the number of days spent in India.

You will be classified as a Resident in India if:

You have stayed in India for 182 days or more during the financial year

OR

You stayed for 60 days or more in the financial year and 365 days or more in the preceding 4 financial years.

Important Information for Indian Citizens Abroad: If you are an Indian citizen working overseas or a crew member on an Indian ship, you can establish residency in India by spending at least 182 days in the country.

This guideline also applies to Persons of Indian Origin (PIO) who visited India in the previous year and have a total income (excluding foreign sources) of 15 lakhs or less. For these individuals, the second residency condition is not applicable.

If one doesn’t meet any of the above conditions, one is a Non-Indian Resident (NRI).

You qualify as an ROR if you satisfy both of the following:

Resident in India for at least 2 out of the 10 preceding financial years, AND

Stayed in India for 730 days or more in the last 7 financial years.

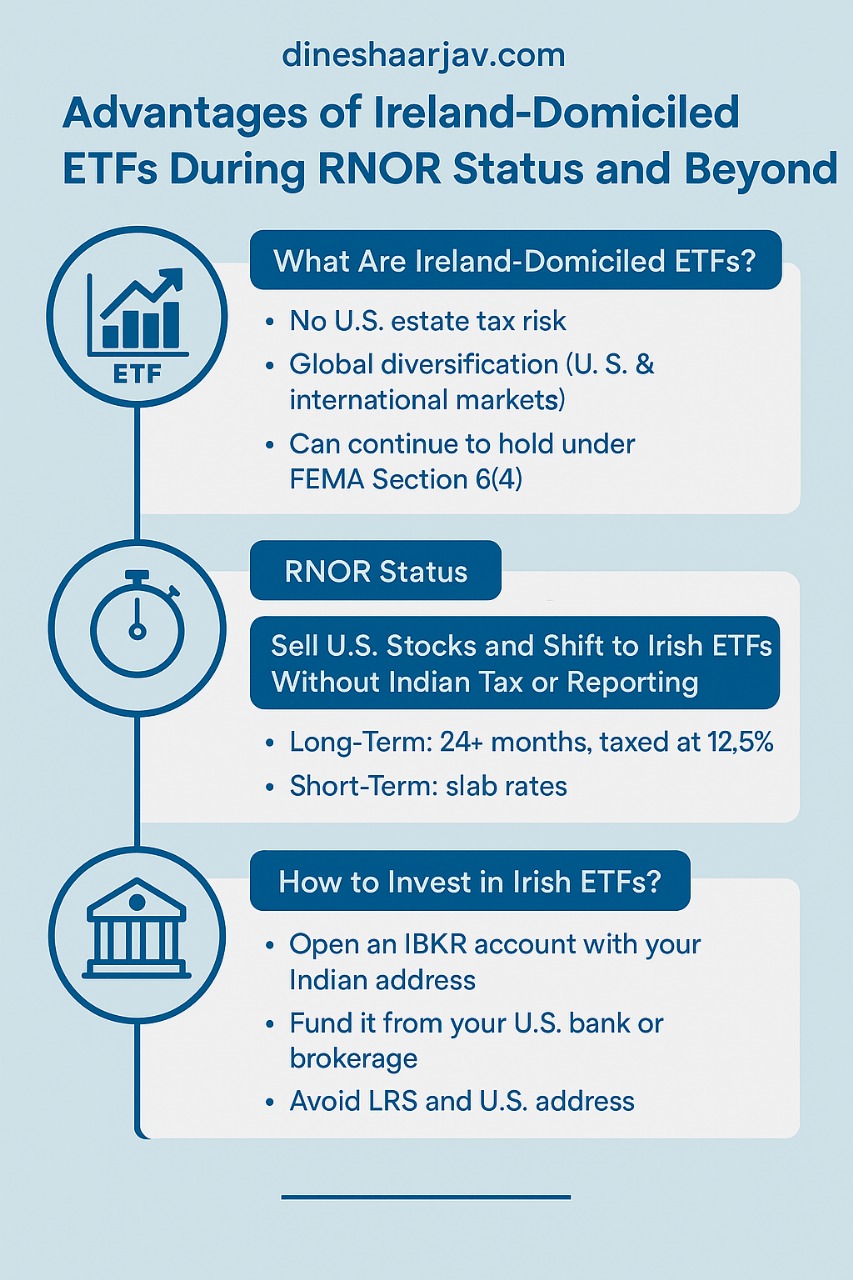

If any one of the above conditions is not met, then you are classified as a Resident but Not ordinary Resident (RNOR).

The Finance Act 2020 has updated residency provisions for Indian citizens and Persons of Indian Origin (PIOs) visiting India, now classifying them as Resident but Not Ordinarily Resident (RNOR) under specific conditions:

Total income (excluding foreign income) is ₹15 lakh or more.

The individual has stayed in India for more than 120 days but less than 182 days in the previous year.

The individual has spent 365 days or more in India in the four years prior to the previous year.

Prior to this amendment, such individuals were categorized as non-residents. Now, this change may impact their residential status, leading to the loss of Double Taxation Avoidance Agreement (DTAA) benefits, increased tax liabilities, and the forfeiture of various exemptions.

Your total income (excluding foreign sources) exceeding ₹15 lakhs also impacts your classification:

If you are an Indian citizen or PIO, and:

Stayed in India for less than 182 days, AND

You are not liable to pay tax in any other country due to reasons like domicile or residence status,

You will be classified as a Deemed Resident of India, and your residential status will be Resident but Not Ordinarily Resident (NOR).

1. Tax Liability: Depending on your residential status, the taxation of income earned in India and abroad is as follows:

|

Scope of Total Income |

ROR |

RNOR |

Not Resident |

|

Income Earned/ received in India |

Taxable |

Taxable |

Taxable |

|

Income earned and received outside India but business & Profession controlled or set up in India |

Taxable |

Taxable |

Not Taxable |

|

Income earned, received & controlled from outside India |

Taxable |

Not Taxable |

Not Taxable |

2. Income Exemptions & Deductions: Income Tax Act offers some benefits and some disadvantages while calculating the total income for NRIs. For example – rebate u/s 87A is not available to the NRIs, interest on NRE Account is exempt for the NRs but it is taxable for RORs & RNORs, DTAA benefits also accrue as per your residential status.

3. Foreign Asset Disclosure: It is mandatory for Residents to disclose their foreign assets in their ITR whereas the same is not required for the NRIs.

Make sure to understand your residential status thoroughly to optimize your tax filings and make use of all applicable exemptions & benefits.

As an NRI (Non-Resident Indian), your salary income is taxable in India if it is received in an Indian bank account or is managed on your behalf. This income will be subject to Indian tax laws and will be taxed at the applicable slab rate. To ensure compliance and optimize your tax liability, it's crucial to seek professional NRI taxation services to guide you through the complex rules.

Salary income is considered to arise in India if your services are rendered within the country. Therefore, even as an NRI, if your salary is paid for services provided in India, it is taxable in India, regardless of where you receive it.

For instance, if you are an Indian citizen working for the Government of India while providing services abroad, your salary will still be subject to taxation in India.

It's also important to note that the income of Diplomats and Ambassadors is exempt from tax.

For example, consider Priya, who worked on a project in Australia for an Indian company for three years. She needed to receive her salary in India to support her family and manage housing loan payments. However, since receiving her salary in India would have subjected her to Indian taxes, Priya chose to receive her salary in Australia instead.

If you are an NRI (Non-Resident Indian) and own property situated in India, the income generated from that property is taxable in India. This applies whether the property is rented out or left vacant. The calculation of income follows the same rules that apply to resident taxpayers. It's essential to understand the regulations around the sale of property in India by NRI to ensure proper tax compliance and optimize any potential deductions.

As an NRI, you can benefit from several deductions:

Standard Deduction: A flat deduction of 30% on the rental income.

Property Taxes: You can deduct property taxes paid.

Home Loan Interest: Interest paid on a home loan is deductible.

Principal Repayment: You can also claim deductions for the principal repayment under Section 80C.

Stamp Duty and Registration Charges: Expenses incurred for purchasing property can be claimed under Section 80C as well.

Income from house property is taxed according to the applicable slab rates.

Example Scenario

Consider Rohan, who owns a house in Mumbai but resides in Singapore. He has set up his rental payments to be deposited directly into his Singapore bank account. Despite living abroad, Rohan’s rental income from his property in India is taxable under Indian law.

If you are a tenant paying rent to an NRI (Non-Resident Indian) property owner, it’s important to remember that you must deduct Tax Deducted at Source (TDS) at a rate of 30% from the rent amount.

You can transfer the rental income either to an Indian bank account or to the NRI’s account in the country where they currently reside.

Example Scenario

For instance, if Ayushi pays a monthly rent of ₹50,000 to her NRI landlord, she needs to deduct 30% TDS, which amounts to ₹15,000, before making the payment.

Form Requirements

In addition to deducting TDS, Ayushi must prepare and submit Form 15CA online to the Income Tax Department. This form is mandatory for anyone making a payment to a Non-Resident Indian. In certain cases, a Form 15CB certificate from a chartered accountant (CA) is also required before submitting Form 15CA online.

Form 15CB must certify:

Payment details

TDS rate and deduction as per Section 195 of the Income Tax Act

Any applicable Double Taxation Avoidance Agreement (DTAA)

Other relevant details regarding the nature and purpose of the remittance

Form 15CB is not required in the following situations:

If the total remittance does not exceed ₹5,00,000 in a financial year—only Form 15CA needs to be submitted.

If a lower TDS deduction applies and a certificate under Section 197 has been obtained.

If the transaction falls under Rule 37BB of the Income Tax Act, which lists specific exemptions. Check the complete list for details.

For all other cases involving remittances outside India, tenants should obtain a CA’s certificate in Form 15CB. Once the certificate is received, Form 15CA should be submitted online to the government.

Interest earned from fixed deposits and savings accounts held in Indian banks is taxable in India. However, interest on NRE (Non-Resident External) and FCNR (Foreign Currency Non-Resident) accounts is exempt from tax. In contrast, interest from NRO (Non-Resident Ordinary) accounts is fully taxable.

Any income generated by an NRI from a business that is either controlled or established in India is also subject to Indian taxation.

As an NRI (Non-Resident Indian), any capital gains from the transfer of capital assets located in India are subject to taxation in the country. This includes capital gains derived from investments in Indian shares and securities.

If you sell a property and realize a long-term capital gain, the buyer is required to deduct TDS at a rate of 12.5%. However, you may be eligible for capital gains exemptions by reinvesting the proceeds in another residential property under Section 54, or in capital gain bonds as specified in Section 54EC.

The tax obligations for NRIs (Non-Resident Indians) in India are determined by their residential status under income tax regulations.

Resident Status: If classified as a resident, your global income is taxable in India.

NRI Status: If you are considered an NRI, only the income earned or accrued in India is subject to Indian taxation.

Income taxable for NRIs includes:

Salary received in India or salary for services rendered in India

Income from house property located in India

Capital gains from the transfer of assets situated in India

Interest earned from fixed deposits or savings accounts held in Indian banks

Income generated outside India is not subject to Indian tax. Additionally, interest on NRE (Non-Resident External) and FCNR (Foreign Currency Non-Resident) accounts is exempt from tax, while interest from NRO (Non-Resident Ordinary) accounts is fully taxable for NRIs.

When NRIs (Non-Resident Indians) invest in specific Indian assets, they are subject to a tax rate of 20% on the income generated. If this investment income is the sole income an NRI has during the financial year and TDS (Tax Deducted at Source) has been withheld, then the NRI is not required to file an income tax return.

Income from the following Indian assets, acquired in foreign currency, qualifies for special tax treatment:

Shares in public or private Indian companies

Debentures issued by publicly-listed Indian companies

Deposits with banks and public companies

Any securities of the Central Government

Other specified assets of the Central Government, as detailed in the official gazette

Please note that no deductions under Section 80 are permitted when calculating investment income.

For long-term capital gains derived from the sale or transfer of these assets, there are no indexation benefits, and no deductions under Section 80 are available. However, you can claim an exemption on the profits under Section 115F if the gains are reinvested into:

Shares of an Indian company

Debentures of an Indian public company

Deposits with banks and Indian public companies

Central Government securities

National Savings Certificate (NSC) VI and VII issues

In this scenario, the capital gains are exempt proportionately if the cost of the new asset is lower than the net consideration. Be aware that if the newly acquired asset is sold or transferred within three years, the previously exempted profits will be added to the income for that year.

These benefits remain available to NRIs even if they later become residents, provided the asset has not been converted to cash and a declaration is submitted to the assessing officer to apply these special provisions.

NRIs also have the option to opt out of these special provisions. In this case, the income (investment income and long-term capital gains) will be taxed under the regular provisions of the Income Tax Act.

Most of the deductions under Section 80 are also available to NRIs. For FY 2023-24, a maximum deduction of up to Rs 1.5 lakh is allowed under Section 80C from gross total income for an individual.

For the financial year 2023-24, NRIs can claim deductions up to ₹1.5 lakh from their gross total income under Section 80C. Here are some of the allowable deductions:

Life Insurance Premiums: Premiums must be paid for a policy in the NRI’s name, their spouse's name, or their child's name (regardless of the child's status). The premium should not exceed 10% of the sum assured.

Children’s Tuition Fees: Tuition fees paid for the full-time education of up to two children in Indian educational institutions qualify for deduction, including fees for play schools and nurseries.

Principal Repayment on Home Loans: NRIs can claim deductions on principal repayments for loans taken to purchase or construct residential properties in India. This includes expenses for stamp duty and registration fees.

Unit-Linked Insurance Plans (ULIPs): Contributions to ULIPs, which provide life insurance coverage, are eligible for deductions under Section 80C.

Equity Linked Savings Schemes (ELSS): Investments in ELSS are popular among NRIs as they offer a deduction under Section 80C up to ₹1.5 lakh, along with potential long-term capital growth.

NRIs can also claim various other deductions, which include:

Deductions from House Property Income: NRIs can claim all deductions available to residents, such as property tax and home loan interest deductions. For more information on house property income, click here.

Deductions Under Section 80D: NRIs can claim deductions for health insurance premiums up to ₹25,000 for themselves, their spouse, and dependent children. For parents, an additional deduction of ₹25,000 is available, which increases to ₹50,000 for senior citizen parents. Preventive health check-ups can also qualify for deductions up to ₹5,000.

Deductions Under Section 80E: NRIs can claim deductions on interest paid for education loans taken for higher studies for themselves, their spouse, children, or a legal guardian. There is no cap on the amount, and the deduction is available for a maximum of eight years or until the interest is fully paid.

Deductions Under Section 80G: Donations made to approved charitable organizations are eligible for deductions under this section.

Deductions Under Section 80TTA: NRIs can claim deductions on interest income from savings bank accounts up to ₹10,000, similar to resident Indians. This applies to savings accounts held with banks, co-operative societies, or post offices.

Certain deductions are not available to NRIs, including:

Investments in Public Provident Fund (PPF): NRIs cannot open new PPF accounts but can maintain accounts opened while they were residents.

National Savings Certificates (NSCs)

Post Office 5-Year Deposit Scheme

Senior Citizen Savings Scheme (SCSS)

Additionally, deductions related to the differently-abled under Sections 80DD, 80DDB, and 80U are only available to resident Indians.

Note: These deductions cannot be claimed under the new tax regime for FY 2024-25

Long-term capital gains for NRIs (Non-Resident Indians) are taxed at a rate of 12.5%. It’s important to note that NRIs are subject to TDS (Tax Deducted at Source) of 12.5% on these gains. However, NRIs can benefit from exemptions under Sections 54, 54EC, and 54F when filing their tax returns, allowing them to claim a refund of the TDS deducted on capital gains.

Section 54: This exemption applies to long-term capital gains from the sale of a house property.

Section 54F: This exemption is available for the sale of any asset other than a house property.

Section 54EC: NRIs can claim this exemption by reinvesting capital gains from the sale of their first property into specific government-notified bonds.

If you prefer not to reinvest in another property, you can invest up to ₹50 lakhs in government-notified bonds.

The investment must be made within six months of the sale to qualify for the exemption, and it should be completed before the tax filing deadline.

The invested amount can be redeemed after three years, but it cannot be sold before five years from the sale date. Note that as of FY 2018-19, the holding period for these bonds has been extended to five years.

Additionally, the exemption under Section 54EC is now limited to capital gains arising from the transfer of long-term capital assets specifically related to land and building. Previously, this exemption was available for any capital asset.

To avoid TDS on capital gains, NRIs must make the required investments and provide relevant documentation to the buyer. They can also claim a refund for any excess TDS deducted when filing their returns.

The following bonds qualify for exemption:

Rural Electrification Corporation (REC) bonds

Power Finance Corporation (PFC) bonds

Indian Railway Finance Corporation (IRFC) bonds

Finance Minister Nirmala Sitharaman has announced significant relaxations in the income tax slabs under the new tax regime for FY 2024-25 in the Budget 2024. Here’s a detailed breakdown of the new income tax slabs:

-Income up to Rs 3 lakh: 0%

-Income from Rs 3 lakh to Rs 7 lakh: 5%

-Income from Rs 7 lakh to Rs 10 lakh: 10%

-Income from Rs 10 lakh to Rs 12 lakh: 15%

-Income from Rs 12 lakh to Rs 15 lakh: 20%

-Income above Rs 15 lakh: 30%

Accordingly, there would be a marginal relief of Rs 10,000 for individual tax-payers opting for new regime. This would further enhance the attractiveness of the new tax regime as compared to the old tax regime, where there are no relaxations proposed.

A salaried person would be paying 0 income tax if their annual salary is INR 7.75 lakhs or lower. This is because the standard deduction has been increased from 50,000 to 75,000. Resulting into a benefit of upto INR 7,500.

The change in slab rate along with the standard deduction increment, a salaried individual can save upto INR 17,500 in taxes.

The tax rate for Short-term capital gains (STCG) from financial assets has been increased from 15% to 20% and similarly the tax rate for long term capital gains (LTCG)from financial and non-financial assets has been increased from 10% to 12.5%.

To encourage the small and marginal tax payers, the exemption limit of long-term capital gains has been increased from 1 lakh to 1.25 lakhs per year.

Another important aspect which is going to impact the NRIs is the taxation of the capital gains from sale of property. The benefit of indexation has been removed and the rate has been decreased from 20% to 12.5%. If you purchased your property within the last 2-5 years, the change might be beneficial. The indexation benefit was minimal for recently bought properties, and the new lower tax rate of 12.5% compared to the previous 20% can save you approximately 7.5% in taxes. This makes selling recently acquired properties more attractive for NRIs, reducing the overall tax burden. For long-term property owners or those selling inherited properties, the removal of the indexation benefit is less favorable. Without indexation, taxes on long-held properties increase significantly. For instance, selling a property bought in 1990 for 1 lakh rupees at 1 crore in 2024 results in a capital gain of 99 lakh rupees, taxed at 12.5%, leading to a higher tax liability.

For the purpose of standardization, there will now be only two holding periods for determining capital gains: 12 months and 24 months.

• For all listed securities, the holding period is 12 months.

• For all other assets, the holding period is 24 months.

Before jumping onto the understanding of who needs to file an ITR, let us take a step back to understand what an ITR is.

An Income Tax Return (ITR) is a document where taxpayers report details of their income earned and the applicable taxes to the income tax department. The government requires individuals to file ITRs to assess their income and ensure that the correct amount of tax has been paid. Filing an ITR is mandatory, and it should be done on or before the specified due date.

If your gross total income is more than the basic exemption limit-

This is for the new regime and for the FY 2024-25:

|

Age Group |

Basic Exemption Limit |

|

For individuals below 60 years |

Rs 3 lakh |

|

For Resident individuals above 60 years but below 80 years |

Rs 3.0 lakh |

|

For Resident individuals above 80 years |

Rs 5.0 lakh |

Note: It is important here to highlight that for Non-Residents the only basic exemption limit relevant is INR 3,00,000 (the first one). The other 2 are only for Resident Individuals.

If your income is below the basic exemption limit, you will still be required to file your tax return if you meet any of these conditions:

Deposited more than Rs 1 crore in 'current' bank account: You have to mandatorily file a tax return if you have deposited a total of Rs. 1 crore or more in one or more current accounts with a bank. However, no such requirement has been specified for deposits made in with post office current accounts; or

Deposited more than Rs 50 lakh in 'savings' bank account: You have to mandatorily file a tax return if you have deposited a total amount of Rs 50 lakh or more in one or more of your savings bank accounts.

Spent more than Rs 2 lakh on foreign travel: You have to mandatorily file a tax return if you have incurred a total expenditure of more than Rs 2 lakh on foreign travel whether for yourself or any other person; or

Electricity expenditure is more than Rs 1 lakh: You have to mandatorily file a tax return if you have incurred more than Rs.1 lakh towards electricity consumption during the previous year; or

TDS or TCS is more than Rs 25,000: If the tax deducted at source (TDS)/ tax collected at source (TCS) exceeds Rs 25,000 in the previous year. In the case of a senior citizen (above 60 years), this limit is Rs 50,000.

Business turnover is more than Rs 60 lakh: In case you are a businessman and your total sales, turnover, or gross receipt is more than Rs 60 lakh during the previous year, then you have to mandatorily file a tax return

Professional income is more than Rs 10 lakh: You have to mandatorily file a tax return if you are engaged in a profession and your gross receipts are more than Rs 10 lakh during the previous year.

If you are a beneficial owner or beneficiary of any asset outside India

If you are a signatory to a foreign bank account.

The answer is YES, if any of the following is applicable to the individual:

If one wants to claim an income tax refund from the department.

If one wishes to apply for a visa

If one has loss from business/profession or under capital gains head, one will not be allowed to carry them forward to the next years unless one files the return before the due date.

If one wishes to claim rebate u/s 87A of Income Tax Act (applicable only for the residents)

If one is looking forward to avail any kind of loan, then one should file ITR. ITR filings are taken as valid income proofs and are often asked while opting for any kind of loan

Ok, so now if one has to file an ITR in India,

Deadline for filing the return: 31st July of every year for the FY ended on 31st March.

Foreign asset disclosure: All foreign asset such as foreign stocks, real estate, bank accounts, bank deposits, insurance policies and other financial assets need to be disclosed in the ITR filed in India (applicable only for the residents). Foreign assets are declared in schedule FA (Foreign Assets).

Advance Tax: Tax-payers have to pay advance tax for the financial year in four installments – June 15, September 15, December 15 and March 15 – if their estimated tax payable exceeds Rs 10,000. If they fail to do so or delay the payment, they will be charged with the interest.

Frequently Asked Questions:

Ans. The TDS on the income may differ from the actual tax liability on the income earned. In general, TDS rates are a fixed percentage of the payments, while your income gets taxed at slab rates. In case the TDS is lower, you may need to pay the balance tax due. In case the TDS is high, you may claim a refund. In any case, while filing your ITR, you should aggregate the annual income from all sources and calculate the tax due/claim refund.

Ans. In India, the double taxation relief is offered to individuals who are charged taxes on the same source of income in India and a foreign country. This is allowed under Section 91 of the Income Tax Act 1961. The relief is also offered if the foreign country in question has a ‘Double Taxation Avoidance Agreement’ with India. Currently, India has a DTAA entered with some 95+ countries.

Ans. If you've missed the deadline to file your income tax returns, there's no need to panic. You still have the option to file your tax returns after the due date. A belated return is a return filed after the deadline i.e. 31st July of the assessment year but before 31st December of the assessment year.

In case you miss the belated return deadline, then you may file ITR-U in certain specified cases.

Ans. Taxability of your income in India depends on your residential status. If you are a Resident, your income earned abroad will also be taxed in India whereas if you are a Non-resident or a RNOR, then your income abroad will not be taxed in India.

Ans. If NRIs tax liability exceeds Rs 10,000 in a financial year, they must pay advance tax. Interest under Section 234B and Section 234C is applicable if advance tax is not paid.

Ans. Yes. You will be liable for capital gains tax in India upon the sale of your flat. Further, the purchaser himself must deduct taxes on the sale consideration. The tax deduction rate for a long-term gain is 12.5%. And one has to claim the refund for the excess TDS at the time of filing the Income Tax Return.

Stay in the loop, subscribe to our newsletter and unlock a world of exclusive updates, insights, and offers delivered straight to your inbox.