WhatsApp

WhatsApp

Call Us

Call Us

Email Us

Email Us

Whatsapp Community

Whatsapp Community

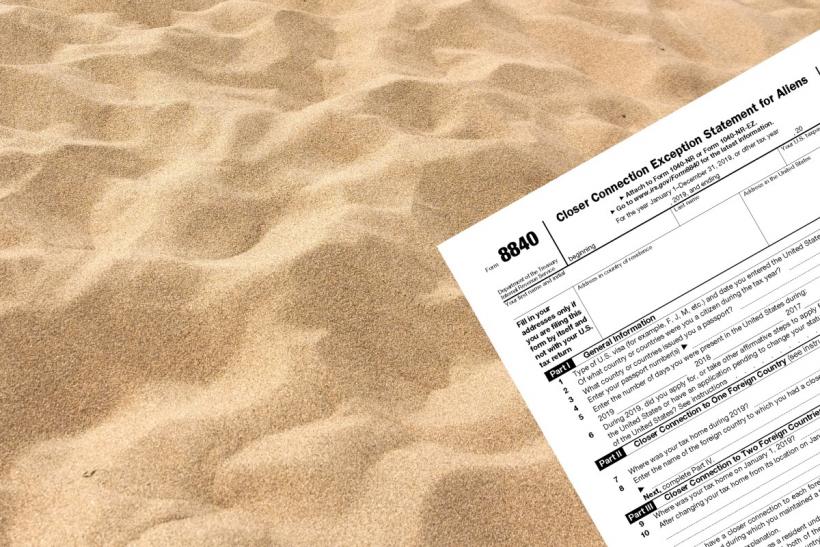

Are you an Indian returning from the United States? Don’t let overlooked tax obligations cost you. Filing Form 8840 and a residency termination statement is critical to staying compliant with US tax laws and protecting your financial future. Here’s your ultimate guide:

When you end your US residency, Treasury Regulations under 26 CFR § 301.7701(b)-8 require submitting a statement indicating your residency termination date with your final tax return (Form 1040-NR). For NRI returning to india, this step ensures the IRS officially recognizes the end of your US tax residency.

Failing to file Form 8840 or the residency termination statement can lead to:

Form 8840 helps you claim the closer connection exception, demonstrating your tax home is outside the US. This protects you from being classified as a US tax resident if you meet the eligibility requirements.

Without proper filings:

Properly resolving your US tax obligations can safeguard your visa status and ensure smooth travel and re-entry to the United States.

At Dinesh Aarjav & Associates, we are trusted experts in NRI taxation and cross-border advisory, serving over 2,600 clients worldwide. With more than 25 years of experience, we provide:

Delays in filing Form 8840 or the residency termination statement can have severe financial repercussions. Act today to ensure a seamless financial transition back to India.

Get Expert Assistance with Dinesh Aarjav & Associates

Simplify your tax journey with our dedicated team. Visit dineshaarjav.com to learn more and schedule a consultation. Trust us to help you navigate US and Indian tax complexities with ease.

By taking these essential steps, you can protect your finances, stay compliant, and build a secure financial future. Stay ahead with Dinesh Aarjav & Associates by your side.